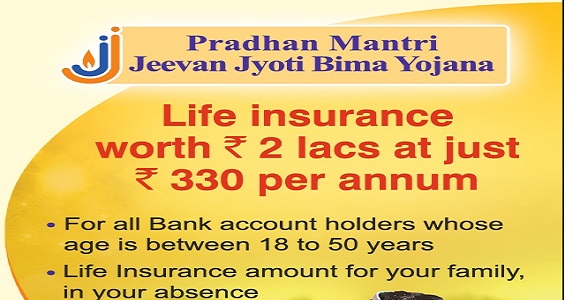

Pradhan Mantri Jeevan Jyoti Bima Yojana

The Prime Minister in an effort to bring all people under the umbrella of insurance has implemented a new kind of insurance scheme called the Jeevan Jyoti Bima. This scheme will cater to the needs of the middle class and poorer sections of the society. It will help them achieve a secure and stress free future knowing that they haven insured.

The Jeevan Jyoti Bima Yojana is not to be confused with the Suraksha Bima Yojana. The former will cover only the event of death for its insurance. A sum of Rs. 2 lakh will be provided to the families in case a sudden death in the family occurs. This death can be due to any reason.

Jeevan Jyoti Bima Premiums

Premiums are a large part of the deciding factor when one is opting for insurance. Mostly people opt out of insurance policies because of the large premiums that have to be paid. Due to the uneven economic distribution, the weaker sections of the society aren’t able to afford a high premium rate. This is why the policy makers have made sure that this insurance policy has very low amounts as premiums.

The premiums for Jeevan Jyoti Bima are only Rs. 330 per annum. This means paying less than a rupee per day and barely Rs. 27.50 per month.

It will be auto debited from the account of the policy holder every year. This means the sum of Rs. 330 will be deducted from the account at once one time each year. To keep the policy ongoing, it is essential to maintain Rs. 330 in the bank accounts before this time.

Since it is a recurring coverage – meaning the coverage shall be renewed every year after payment of the premiums, it s important that you pay the premiums on 1st June every year, to get the benefits. Once the amount has been paid, your coverage shall last till 31st May of the following year.

Can this policy be terminated?

Just like all other insurance policies, the Jeevan Jyoti Bima policy can be terminated as well. The only time this policy can terminate however, is if the insured person has reached 55 years of age. However for this policy to be effective, the policy holder needs to keep updating it till the time they reach that age.

Another time the policy is eligible to be terminated is when the policy holder does not have sufficient funds in his account and chooses to let the policy terminate on its own. Also, if it is found out that the policy holder has more than one account and they intend to achieve the benefits by any unscrupulous means, then the policy will be forfeited. This means that anything they have deposited until now will be invalid.

Any amount that is due above the premiums will be paid by the government from the public welfare funds.

Here are more things that you might have missed:

| Types | Info | More info |

| Eligibility | Age 18 to 50 years. Citizen of India. | Above 55 years not eligible |

| Premium | Rs. 330 per annum | One installment |

| Payment mode | Auto debited from the bank account | Yearly auto debited |

| Coverage | Rs. 2 lakh for death due to any reason | Recurring coverage scheme |

| Implementation | Life Insurance Corporation of India | Tie up with other banks |

Other Articles

- Pradhan Mantri Suraksha Bima Yojana

- Pradhan Mantri Atal Pension Yojana

- Genome Savior Award